The luxury apartment market in India has experienced a significant boom, especially among Non-Resident Indians (NRIs), who are increasingly turning to high-end properties for investment. Recent reports indicate that the luxury residential real estate market is expected to grow considerably, with homes priced over ₹1 crore making up 41% of total sales in early 2024.

While the charm of luxury living is certainly attractive, NRIs need to approach this investment with a well-planned budget. Keep reading to understand how NRIs can budget wisely for their dream luxury apartment without financial difficulties.

Understanding Your Financial Landscape

Buying or renting a luxury apartment is nonetheless an exciting experience, but before investing, you need to assess your current financial situation. This requires an accurate calculation and evaluation of their income and expenditure.

- Calculating Total Income:

It includes total earnings from all sources, such as salaries, rental income from properties abroad, etc.

- Evaluating Monthly Expenses:

List fixed expenses (like mortgages or rent) and variable expenses (like groceries and entertainment) to understand your spending habits. Assessing income and expenses provides a clear picture of your financial capacity to invest in a luxury apartment.

Importance of Credit Scores and Financial Health

Credit score plays a significant role in determining whether an individual is eligible for loans and mortgages. A higher credit score increases the possibility of acquiring better interest rates. Thus, your credit score can significantly affect your overall budget for your dream luxury apartment.

You need to monitor their credit score regularly through various financial services to stay updated about their credibility. Also, it is necessary to pay off outstanding debts and avoid taking on new debt before applying for a mortgage.

Setting Realistic Financial Goals for Luxury Living

It is essential to set a realistic financial goal while investing in luxury apartments. Setting short-term goals such as saving money to pay a down payment, as well as long-term goals like analysing how buying the specific property aligns with your overall investment strategy. Setting realistic goals will help guide your budgeting process and keep you focused on achieving your dream home.

Researching Luxury Apartment Options

The location of your luxury apartment significantly impacts its value and livability. Popular cities where NRIs can invest in luxury living include Mumbai (high-end properties, vibrant lifestyle), Delhi (high property sale ratio), and Bengaluru (tech hub, luxury living space).

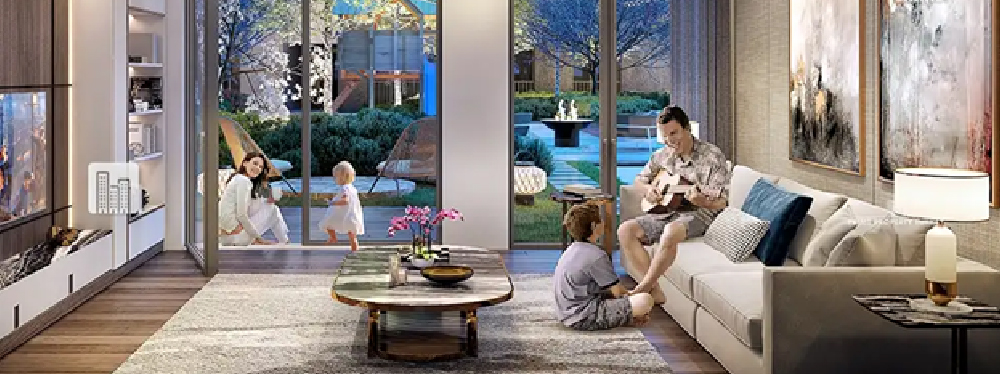

As per records, nearly 29% of the NRIs are willing to invest in Bengaluru properties, considering the cosmopolitan lifestyle, proximity to tourist spots, blooming IT sectors, etc. To match their sophisticated lifestyle, NRIs prefer buying luxury properties featuring top-notch amenities and smart features.

Thus, while researching for your dream luxury apartment, always consider advanced amenities and features like pools, gyms, smart home technologies, eco-friendly designs, bespoke interior finishes, etc. Evaluating these features will help you determine which properties align with your lifestyle preferences and budget.

Read Also: Top Indian States Offering Benefits for NRI Luxury Property Buyers

Understanding the Long-Term Investment Potential

Investing in a luxury apartment is not just about immediate enjoyment; it’s also about long-term value. Here are some of the factors to consider while looking for luxury properties:

- Market Trends:

Historical trends indicate that luxury properties often appreciate at rates significantly higher than average residential properties. For example, property prices in Bangalore have surged by 57% over the past five years due to its status as an IT hub and vibrant social infrastructure.

- Higher Rental Yields:

Luxury apartments typically yield better rental returns compared to standard residential units. This makes them an appealing option for NRIs looking to generate passive income while benefiting from long-term capital appreciation.

- Future Developments:

Upcoming real-estate projects by builders like Rustomjee, infrastructural and social developments in major cities, etc. ensure the growth of luxury living in India. Thus, the real estate market will experience higher value in upcoming years.

Understanding these elements will help you make an informed decision about your investment.

Budgeting Basics for a Luxury Apartment

When budgeting for a luxury apartment, it’s essential to account for all associated costs:

- Down Payment or Security Deposit: Usually, it’s 20% of the property value.

- Monthly Mortgage or Rental Payments: Calculate based on prevailing interest rates or rental prices in your chosen location.

- Maintenance Fees and Property Taxes: Factor in monthly maintenance fees (if applicable) and annual property taxes.

Beyond the primary costs, the following additional expenses may arise:

- Home Insurance: Protects against potential damages; costs vary based on property value.

- Utility Bills and Living Expenses: Include electricity, water, internet, and other recurring expenses in your budget.

- Stamp Duty and Registration Fees: When purchasing a property, stamp duty (ranging from 3% to 7% depending on the state) and registration fees must be accounted for.

- Brokerage Fees: If using a real estate agent, expect to pay around 2% of the property’s value as brokerage fees.

Creating a comprehensive list of all potential costs will ensure that you are financially prepared for owning or renting a property.

Read Also: NRI Home Loan vs Normal Home Loan: Which One Suits You Best?

Creating a Realistic Budget

Following the steps below can help draft a realistic budget for your luxury apartment:

- List All Income Sources: Document all income streams available to you.

- Estimate Monthly Expenses: Create categories for fixed and variable expenses.

- Calculate Available Funds for Housing: Subtract total monthly expenses from total income to determine how much you can allocate towards housing.

- Include Savings Goals: Set aside funds for emergencies or future investments.

This structured approach helps clarify how much you can realistically spend on a luxury apartment while maintaining financial stability.

Tools and Resources for Effective Budgeting

Utilising budgeting tools can simplify the process:

- Budgeting Apps: Consider apps like Mint or YNAB (You Need A Budget) that help track spending and savings goals.

- Spreadsheets: Create custom spreadsheets to manage finances according to personal preferences.

These resources can provide insights into spending habits and help keep you accountable. Apart from these, you can appoint financial advisors for valuable guidance throughout the budgeting process. They help offer insights into improving credit scores or managing debt. Besides, they assist in aligning real estate investments with broader financial goals.

Financing Options for NRIs

Financing luxury apartments in India for NRIs involves several options.

- Home loans and mortgages are available from various banks, allowing NRIs to purchase, construct, or renovate properties. Each financial institution has different eligibility criteria and interest rates, so comparing options is essential.

- NRIs must also understand foreign exchange rates, as fluctuations can impact loan repayments.

- Additionally, remittance options through NRE/NRO accounts facilitate easy EMI payments.

By exploring these financing avenues, NRIs can make informed decisions and effectively manage their investments in luxury real estate in India.

Saving Strategies for Luxury Living

Saving strategies for luxury living by NRIs involve a multifaceted approach to maximise financial health. To enhance savings, NRIs should automate transfers to savings accounts or investment funds, ensuring a portion of income is consistently set aside. Exploring investment opportunities, such as mutual funds or real estate, can facilitate wealth growth over time.

Additionally, maintaining an emergency fund equivalent to three to six months’ expenses is crucial for financial security. This fund provides a safety net against unexpected costs, allowing NRIs to enjoy their luxury lifestyle while safeguarding their financial future.

Making the Purchase or Rental Decision

While purchasing or renting a luxury apartment, NRIs need to consider several factors. First, assess the location and ensure it aligns with your lifestyle preferences and offers robust connectivity and amenities. Security factors and neighbourhood are also crucial factors as they impact both comfort and property value.

Legal assistance is essential; engaging a qualified attorney can help navigate the complexities of property laws and ensure due diligence on title verification and ownership rights. This step mitigates risks associated with hidden costs or legal disputes.

Conclusion

Effective budgeting is essential when considering the purchase or rental of a luxury apartment. By creating a realistic budget, exploring financing options, implementing savings strategies, and making informed property decisions, you set yourself up for success in this exciting venture.

At Rustomjee, we are committed to helping you navigate this journey seamlessly. Our expertise in luxury real estate ensures that you find not just an apartment but a home, aligning perfectly with your aspirations and budgetary constraints.

Looking forward to owning your dream luxury apartment? Contact Rustomjee today!

FAQs

- Are there tax implications for non-resident Indians investing in Indian property?

NRIs may be subject to capital gains tax upon selling their property; however, they may also benefit from tax deductions on home loans under certain conditions.

- Can NRIs get home loans in foreign currency?

Yes, many banks offer home loans in foreign currencies, which can be advantageous depending on exchange rate fluctuations. However, it is important to consider the potential risks involved with currency fluctuations, which could impact loan repayments.

- How does RERA impact NRI investments?

The Real Estate (Regulation and Development) Act (RERA) enhances transparency in transactions by regulating builders and ensuring timely project delivery, making it safer for NRIs investing in Indian real estate.

- What are the factors to consider when renting a luxury apartment?

Evaluate lease terms carefully, including maintenance responsibilities, duration of lease agreements, and any additional fees associated with amenities.